| New York

Architecture Images- Recent Hudson Yards - Brookfield Towers |

|

| Please note- I do not own the copyright for the images on this page. | |

|

architect |

som |

|

location |

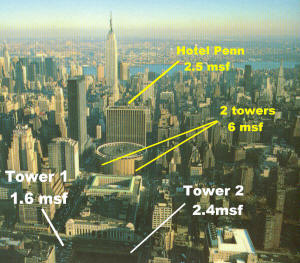

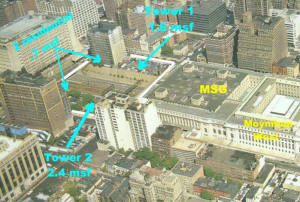

Hudson Yards- 5.4-million-square-foot property that runs from Ninth Avenue to Dyer Avenue, between West 31st and West 33rd Streets |

|

date |

|

|

style |

Neomodern architecture |

|

type |

Office Building |

|

construction |

|

|

|

|

|

|

|

|

|

|

|

|

notes |

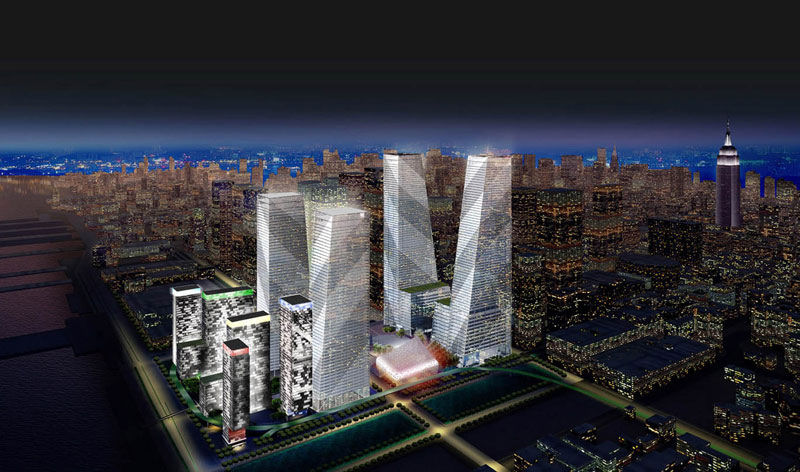

Projects Shelved in the Downturn Spring Back to Life By JULIE SATOW, April 26, 2011 During the recession the developer Brookfield Office Properties shelved plans to build several office towers on a 5.4-million-square-foot property that runs from Ninth Avenue to Dyer Avenue, between West 31st and West 33rd Streets. But Brookfield did not ignore the project in the downturn. The developer spent the last several years studying the engineering of a deck over the rail yards on the site, and says it has found a way to build it cheaper and quicker. It will start construction later this year, with plans to deliver a two-million-square-foot office tower designed by Skidmore, Owings & Merrill on the northeast corner of the parcel by 2015. There are plans to eventually construct as many as three towers. “We will start building the deck on spec but are confident that by the time we get around to building the tower, we will have found an anchor tenant,” said Ric Clark, the president and chief executive. While he declined to give asking rents for the tower, Brookfield has begun preliminary conversations with tenants and expects to be competitively priced with the Hudson Yards buildings the Related Companies is planning a few blocks west. As rents rebound and vacancies fall in the New York office market, some developers like Mr. Clark who shelved projects in the recession are resurrecting their plans. Several buildings are in the pipeline, and nearly 9.5 million square feet could become available over the next few years — in addition to several million more square feet at the World Trade Center in Lower Manhattan and the Hudson Yards. A number of factors are driving the trend. Commercial rents are rising in certain submarkets and have held steady in others. Builders who believe the market has turned are preparing sites now in the hopes their projects will come online when higher rents are firmly established. The city’s aging office stock is another factor. Nearly 83 percent of the office buildings in Manhattan were built more than three decades ago, according to the real estate company Cassidy Turley, and just 6.6 percent have been built since 1990. Many tenants, particularly law firms and financial services companies, crave new space that can be more efficient and tailored to their needs. Finally, construction costs could fall as union contracts begin expiring over the next few months and contractors push to exclude costly labor rules.  “A year ago people were saying the market was so bad they wouldn’t contemplate ground-up construction,” said John F. Powers, the chairman of the New York tri-state region for CB Richard Ellis. “But now, there is upward pressure on rents in some segments of the market, and certainly there is no more downward pressure, so developers are beginning to run pro formas again,” he said, referring to the method of estimating a project’s cost. In the first quarter of this year there were 15 office leases in Midtown at rents above $90 a square foot, compared with 23 for all of 2010, according to Cushman & Wakefield. At the same time the vacancy rate in Midtown has dropped to 10.3 percent, compared with 12.6 percent at this time last year.  Tenants considering locking in new space now, before rents rise further, include Time Warner Inc., the financial services behemoth UBS and the law firm Mayer Brown. According to Cassidy Turley there are 446 tenants in the market chasing less than 28 million square feet of space. Particularly well-poised are those developers who had begun preparing before the recession and can resume construction now at points further along. Pacolet Milliken Enterprises, the sister company of the textile firm Milliken & Company, demolished the building at 1045 Avenue of the Americas, a full block between West 39th and West 40th Streets, in 2009. The company has completed the schematic design for a 350,000-square-foot office building at the now-vacant lot, and has hired the Houston-based real estate firm Hines as a consultant. “We feel very confident about the market and the location,” said Richard C. Webel, Pacolet Milliken’s president. He said the company had been speaking preliminarily with tenants, though it had not yet hired a broker. As for timing, “based on who we have talked to, the market should be there by 2015 or 2016, if not sooner,” Mr. Webel said. Timing is critical as the market starts to revive, experts said. “The first buildings to be up and running will be most successful in grabbing an anchor tenant,” said Robert Sammons, the vice president for research services at Cassidy Turley. Boston Properties is banking on this as it revives construction on a 1-million-square-foot office tower at 250 West 55th Street; building stopped in 2008 after the foundation was poured. Since it is partially built, it will be a relatively short time — mid-2014 — until Boston Properties can deliver the building to tenants. Already, it is in lease negotiations with the law firm Morrison Foerster as an anchor tenant. Another tower that is being closely watched is 20 Times Square. Vornado Realty Trust has had a plan for the 1.25 million-square-foot office building, which will be built over the Port Authority Bus Terminal, for several years. Steven Roth, Vornado’s chairman, recently said he would consider erecting the tower before signing an anchor tenant, thanks in part to a multimillion-dollar cash infusion from an unnamed investor. Not all of the new construction is in Midtown. In Greenwich Village, Edward J. Minskoff Equities is expecting to break ground this summer on 51 Astor Place, a 430,000-square-foot mixed-use mixed-use office building. “With technology getting hot again, and Midtown South having the lowest vacancy rate in the country at 8 percent, a new building in the vicinity should do well,” Kenneth J. McCarthy, the senior economist and senior managing director for research at Cushman & Wakefield, said. Another factor that could spur development is coming contract negotiations between the construction trade unions and contractors. Thirty labor-contractor collective bargaining agreements are set to expire on June 30, and contractors are pressing for significant cost reductions. Already, builders have been increasingly using nonunion laborers for projects, and among the sticking points will be what some contractors and owners consider archaic and costly work rules. “One part of the equation is rents, but the other part, which is very important, is the cost of construction,” Mr. Powers said. While it would be a boon for developers if labor costs were reduced, the fight is expected to be tough, said John Krush, an executive managing director at Newmark Knight Frank Project & Development Management. There is a possibility that unions could call for work stoppages, and “a stoppage of any length — one month, one week — would be incredibly costly for developers,” he said. “Negotiations are just beginning, and it is far too soon to speculate about whether there will be work stoppages, or what may or may not happen,” said Gary LaBarbera, the president of the Building and Construction Trades Council of Greater New York. Still, office development seems poised to rebound. “There are several players who have financing, who have the land, and have been waiting on the sidelines for some indications that the market is improving,” Mr. Sammons said. For those builders, “the time is now.” A version of this article appeared in print on April 27, 2011, on page B8 of the New York edition with the headline: Projects Shelved In the Downturn Spring Back to Life. Source- http://www.nytimes.com/2011/04/27/business/27sites.html?pagewanted=all  Manhattan West is a 5,400,000-square-foot (500,000 m2) mixed-use development by Brookfield Properties which is currently in the planning stages. The project consists of two large office towers and two smaller residential towers. The towers will be built on a platform over railroad tracks along Ninth Ave. The buildings will be built close to the developing Hudson region between 31st and 33rd streets. These two buildings have been proposed as of 2010 and their approval is still pending. If built the west tower would extend 1,216 ft and would be one of the tallest buildings in New York City. ----------------- OK, Brookfield — where’s that platform you promised you’d start building at your Manhattan West site? CEO Ric Clark told us last February that work on the rail yard deck would start in the spring. All that stood in the way, he and company president Dennis Friedrich said, was nailing down fine points of an agreement with Amtrak, which controls the tracks in the yard 65 feet below street level at the five-acre site bounded by Ninth and Tenth avenues and West 31st and 33rd streets. We gave it big play under the headline, “Manhattan West, On Deck.” But work has yet to start on the deck, which is central to Brookfield’s plan for three large towers and a big retail component even though it isn’t necessary to support them. The company declined to comment. But sources familiar with the situation said that, among other things, the new idea of using at least one of the three planned towers for residential rather than commercial — recently raised by Friedrich in an investors’ conference call — has caused Brookfield to “make sure everything’s aligned to accommodate that possibility.” And, sources said, the Amtrak agreement still isn’t nailed down. After first announcing its deck plan in 2006, Brookfield has several times told media including The Post it would start building it by various dates, but failed to meet any of the timetables. Big dreams often take longer than first imagined, and Brookfield can afford to wait — but shouldn’t a giant, publicly traded company be a little more cautious with cheery forecasts it might not be able to meet? |

|

|

|

|

|

Brookfield Taps SOM for Other West Side Rail Yards by Eliot Brown | February 21, 2008 Brookfield Properties seems to like the architectural veterans over at Skidmore Owings and Merrill these days. Brookfield brought on the longtime firm to design its two signature towers in its bid for the West Side rail yards, and now the mega-office landlord has released an SOM-designed rendering for two office towers on a superblock to the east, bounded by 31st and 33rd streets, and Ninth and 10th Avenues (which are rather reminiscent of the designs for the rail yards to the east). The site currently opens to rail tracks that lead into Pennsylvania Station. The Times’ Charles Bagli had a piece today on Brookfield’s development, and while the print edition had a small rendering, the online version went without it. Accordingly, I called over to the folks at Brookfield, and they gave us the pretty picture to the right. Brookfield announced plans earlier this month to start construction on a $600 million platform over the rail tracks around June, with completion expected in 2010. The first of the office/mixed-use towers could see completion by 2013; though, as CEO Ric Clark told us a few months back, they probably won't build without a tenant Source- http://www.observer.com/2008/brookfield-taps-som-other-west-side-rail-yards Work to Begin on Platform Over Tracks on the West Side By CHARLES V. BAGLI, February 21, 2008 Despite a flagging economy, Brookfield Properties says it will start work in June on a $600 million platform over railroad tracks near Ninth Avenue, where it plans to build two towering office buildings. Brookfield, a major commercial landlord in Manhattan, has owned the property between Ninth and Dyer Avenues, between 31st and 33rd Streets, for more than 22 years. But it has had difficulty luring a prominent company to what has long been regarded as Manhattan’s last real estate frontier. The company now says the time is ripe to begin work. Development is pushing westward, and the site is only one block west of Pennsylvania Station. The vacancy rate for Manhattan office buildings is still relatively low, and the credit markets should recover fairly quickly from the subprime mortgage crisis, said Richard B. Clark, chief executive of Brookfield. “For a long time, we believed that the West Side would be the city’s next commercial zone,” Mr. Clark said. “It’s clear that the time is now to make something of this site.” Brookfield’s project is no simple matter. More than half of the five-acre site is over railroad tracks, which extend from Pennsylvania Station to the West Side railyards. Brookfield must build a three-acre platform, while trains continue to run below, before it can start putting up its first building. It hopes to sign a major tenant during the two years the job is expected to take. Brookfield’s architect, Skidmore, Owings & Merrill, has designed two towers, a 1.9-million-square-foot building at the northeast corner of the site and a 3.4-million-square-foot building at the southeast corner. In many respects, the project is a warm-up for the West Side railyards, where five developers are competing for the development rights. At the railyards, between 10th and 12th Avenues, from 30th to 34th Streets, developers will have to build two 13-acre platforms, at an estimated cost of $1.5 billion. They would then have the right to build 12 million square feet of high-rise office and residential buildings. Brookfield is one of the companies expected to submit a second round of bids to the Metropolitan Transportation Authority on Tuesday. But with concerns about the economy growing, many real estate executives and government officials worry that developers may reduce their offers. Brookfield is not alone in pushing forward with new office projects. Even so, some real estate executives warn that some of those projects could be postponed, especially if the developer lacks an anchor tenant, and new buildings may not rise over the West Side railyards for years. Over the past five years, developers have largely ignored office projects in favor of erecting lucrative residential towers, even though the destruction of the World Trade Center sharply reduced available office space. In that time, developers built only 16 commercial buildings with a total of 14.4 million square feet, according to the Real Estate Board of New York. As companies expanded, space became tight and commercial rents soared, with many prime buildings now fetching more than $100 a square foot in annual rent. So developers are once again putting up office towers, some without an anchor tenant. There are four towers under construction, with a combined total of 6.7 million square feet, and another four towers with 11.3 million square feet planned. SJP Properties is building a 1.1-million-square-foot tower at Eighth Avenue and 42nd Street. To the north, Boston Properties is excavating a site between 54th and 55th Streets for a 39-story, 1-million-square-foot building that is scheduled to be finished in 2010. A year from now, Boston Properties and its partner, Related Companies, plan to start a second tower, with 900,000 square feet, at Eighth Avenue between 45th and 46th Streets. “We obviously continue to feel good about west Midtown,” said Robert E. Selsam, senior vice president of Boston Properties. At the World Trade Center site, the Port Authority of New York and New Jersey is building the 2.6-million-square-foot Freedom Tower, and JPMorgan Chase has signed a deal to erect a 1.3-million-square-foot building nearby. And on Church Street, the developer Larry Silverstein is beginning work on what will be three 60-story skyscrapers with a total of 6.2 million square feet. Source- http://www.nytimes.com Manhattan West is a 5.4 million square foot mixed-use development by Brookfield Properties which is currently in the planning stages. The project consists of two large office towers and two smaller residential towers. The towers will be built on a platform over railroad tracks along Ninth Ave. between 31st and 33rd streets. ------------ The Metropolitan Transit Authority (MTA) announced today that Tishman Speyer Properties, owner of such landmark properties as Rockefeller Center, the Chrysler Building, and the Hearst Building, has won the right to build on the West Side Rail Yards with a $1 billion bid. The 26-acre site located between 30th and 33rd Streets from 10th Avenue to the Hudson, is the largest remaining undeveloped site in Manhattan. Tishman’s proposal, which is designed by Chicago architect Helmut Jahn and New York-based Cooper Robertson with landscape architect Peter Walker, will bring a taste of Rome to Manhattan, with a masterplan that includes elements that are takes on the Roman forum and the Spanish Steps. The plan calls for five office towers with 8.1 million square feet of space, 3,000 residential units, 13 acres of open space, a new public school and a 200,000 square foot cultural center. As part of the plan, Tishman will preserve the Highline, an elevated disused rail line that runs from Chelsea to Mid-town, which is to be transformed into a linear park. source: worldarchitecturenews |

|

|

|